what items are exempt from sales tax in tennessee

To learn more see a full list of taxable and tax-exempt items in Tennessee. Tennessee has a statewide sales tax rate of 7 which has been in place since 1947.

Sales Tax On Grocery Items Taxjar

Public Chapter 592 2021 effective July 1 2021 creates a new one-year sales tax holiday for the period beginning 1201 am.

. The tax-free holiday weekend focusing on clothing and other back-to-school items begins at. A textbook is defined as a printed book that contains systematically organized educational information that covers the primary objectives of a course of study. 18 rows In Tennessee certain items may be exempt from the sales tax to all consumers not just.

Therefore no holiday is necessary. How to use sales tax exemption certificates in Tennessee. On Friday July 31 and ends Sunday August 2 at 1159 pm.

Some exemptions are based on the product purchased. In the state of Tennessee only the entity that remitted the tax to the state can be refunded the tax dollars therefore Tennessee manufacturers must request a sales tax refund directly from their vendors. Contractors generally owe sales or use tax on the purchase.

This does not include a book primarily published and distributed for sale to the general public. During this time exempt items include. This page describes the taxability of manufacturing and machinery in Tennessee including machinery raw materials and utilities fuel.

It is not an all-inclusive document or a substitute for Tennessee sales or use tax statutes or rules and regulations. SUT-21 - Sales and Use Tax for Contractors - Overview. Sales of medical services are exempt from the sales tax in Tennessee.

Since the state of Tennessee started collecting a sales tax in 1947 certain items have been considered tax-exempt because these items go into producing items which will be taxed by the end consumer. Computers with a price of 1500 or less per item. Groceries is subject to special sales tax rates under Tennessee law.

You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to. Clothing does not include belt buckles. To learn more see a full list of taxable and tax-exempt items in Tennessee.

To learn more see a full list of taxable and tax-exempt items in Tennessee. On June 30 2022. One Year Sales Tax Holiday for Gun Safes and Gun Safety Devices.

Sales of medical devices are exempt from the sales tax in Tennessee. Clothing with a price of 100 or less per item. Although services by the above entities are exempt from business tax these entities may be liable for business tax if they make other types of sales that do not fall within this exemption.

SUT-33 - Sale for Resale - Out-of-State Resale Certificates. Therefore not double taxing items in the production pro-cess both manufacturing and agriculture have these types of sales tax exemptions. School and school art supplies with a price of 100 or less per item.

Information for farmers timber harvesters nursery operators and dealers from whom they buy to understand the scope of exemptions and reduced rates the purchases that remain taxable and how to effectively administer these tax provisions. During this period retail sales of gun safes and gun safety devices are exempt from sales and use tax. The maximum local tax rate allowed by Tennessee law is.

The sales tax resale exemption is allowed for dealers purchasing items or taxable services in Tennessee that they normally resell. This page describes the taxability of occasional sales in Tennessee including motor vehicles. Sales of medicines are subject to sales tax in Tennessee.

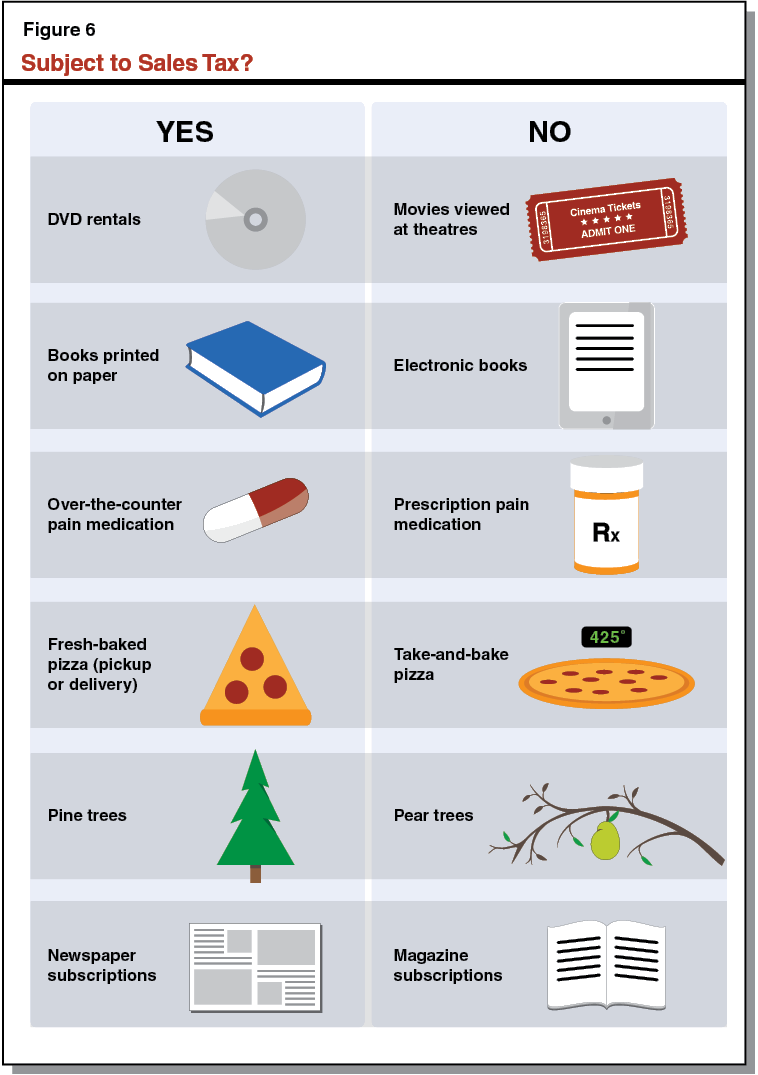

Several examples of items that are considered to be exempt from Tennessee sales tax are medical supplies certain groceries and food items and items which are used in the process of packaging. This article has been updated to reflect the repeal of Sales and Use Tax Rule 96 and is effective January 10 2022. In most states necessities such as groceries clothes and drugs are exempted from the sales tax or charged at a lower sales tax rate.

Tennessee Department of Revenue July 2020. To apply for entity exemptions available in Tennessee go to the Sales and Use Tax Forms on the left. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases.

Municipal governments in Tennessee are also allowed to collect a local-option sales tax that ranges from 15 to 275 across the state with an average local tax of 2614 for a total of 9614 when combined with the state sales tax. While Tennessees sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. STH-8 - Types of Clothing Items that Qualify for Sales Tax Holiday Exemption.

On July 1 2021 and ending at 1159 pm. 43 rows In the state of Tennessee sales tax is legally required to be collected from all tangible. Tennessee does not exempt any types of purchase from the state sales tax.

A dealer making purchases for resale must provide its. During the holiday the following items are exempt from sales and use tax. There are a number of exemptions and exceptions from the requirement to collect and remit.

Tax Exempt Items for 2020. For example gasoline textbooks school meals and a number of healthcare products are not subject to the sales tax. This includes shirts dresses pants coats gloves and mittens hats and caps hosiery neckties belts sneakers shoes uniforms whether athletic or non-athletic and scarves.

SALES AND USE TAX 2 Dear Tennessee Taxpayer This sales and use tax guide is intended as an informal reference for taxpayers who wish to gain a better understanding of Tennessee sales and use ta x requirements. While Tennessees sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. Medical Dental and Allied Health Services The sales of medical dental and allied health services to human beings SIC Major Group 80.

Clothing is defined as human wearing apparel suitable for general use. 12 -Tennessee Sales Tax Exemptions. Textbooks and workbooks are exempt from sales tax.

Composition Books School supply. Generally contractors and subcontractors are users and consumers and must pay tax on the purchase price of materials supplies and taxable services that are used in the performance of their contract to make improvements to realty. If you sell any exempt products you should not collect sales tax on the sales.

Tennessee manufacturers can recover sales tax dollars erroneously paid on exempt items up to 3 years 36 months after the sales tax was paid. Clothing with a sales price of 200 or less per item School supplies with a sales price of 200.

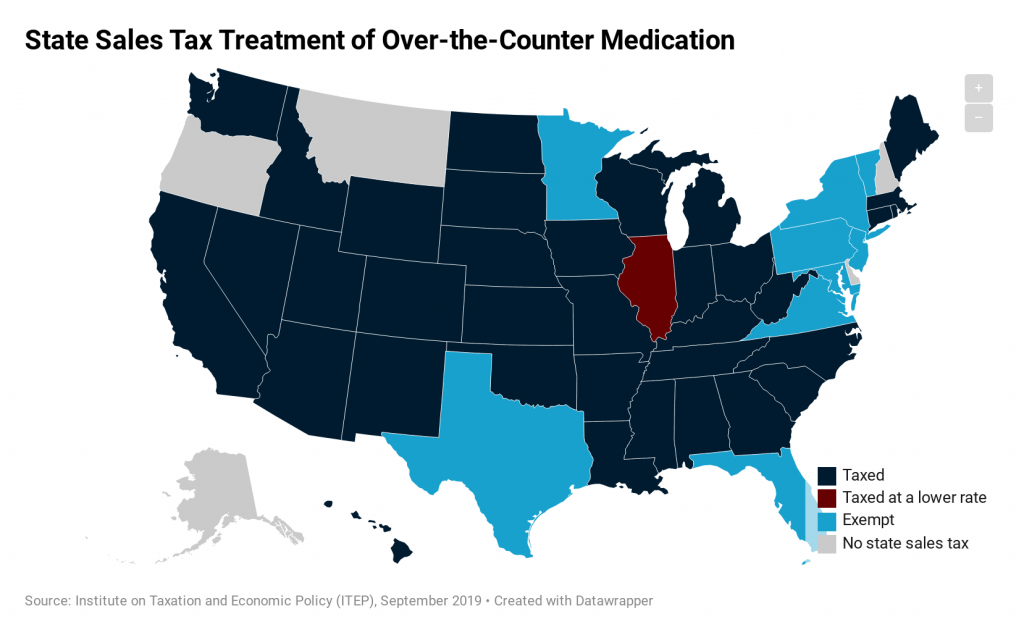

How Do State Tax Sales Of Over The Counter Medication Itep

Sales Tax On Grocery Items Taxjar

What Canadian Businesses Need To Know About U S Sales Tax Madan Ca

Sales Taxes In The United States Wikiwand

How To Charge Your Customers The Correct Sales Tax Rates

Understanding California S Sales Tax

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Sales Tax Exemption For Building Materials Used In State Construction Projects

States With Highest And Lowest Sales Tax Rates

What Is An Exemption Certificate And Who Can Use One Sales Tax Institute

Understanding California S Sales Tax

What Is A Sales Tax Exemption Certificate And How Do I Get One

Sales Tax Holidays The Cpa Journal

Sales Tax By State Non Taxable Items Taxjar

Monday Map Sales Tax Exemptions For Groceries Tax Foundation

Louisiana Sales Tax Small Business Guide Truic

Sales Tax Rates And Exemptions For Agricultural Manufacturing And Download Scientific Diagram

Sales Taxes In The United States Wikiwand

List Of Tax Exempt Items Baby Receiving Blankets Emergency Kit Receiving Blankets