us japan tax treaty withholding rate

Under US domestic tax laws a foreign person generally is subject to 30 US tax on a gross basis on certain types of US-source income. Income Tax Treaty SUMMARY On January 24 2013 Japan and the United States signed a protocol together with an exchange of notes related thereto the Protocol amending the income tax treaty signed by the two countries in 2003 as.

Russia S Double Tax Agreement With Hong Kong Reducing Taxes In Bilateral Trade Russia Briefing News

Tax Treaty Japan and the United States Sign a Protocol Amending the Existing Japan-US.

. Summary of US tax treaty benefits. Covered taxes in Japan are expanded to include the national consumption tax inheritance tax and gift tax. Article 11 of the United States- Japan Income Tax Treaty allows the source state to impose a withholding tax of 10 percent if paid to a resident of the other Contracting State that beneficially owns the interest.

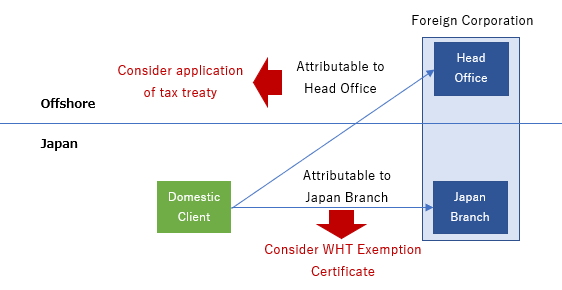

Application of tax treaty. Tax Rates on Income Other Than Personal Service Income Under Chapter 3 Internal Revenue Code and Income Tax Treaties Rev. Withholding Tax Rate Afghanistan No 30 Albania No 30 Algeria No 30 American Samoa No 30 Andorra No 30 Angola No 30 Anguilla No 30 Antarctica No 30 Antigua and Barbuda No 30 Argentina No 30 Armenia Yes 30 Aruba No 30 Australia Yes 15 Austria Yes 15 Azerbaijan Yes 30 Bahamas No 30 Bahrain No 30 Bangladesh.

The Japan-US double tax agreement stipulates that a 10 withholding tax is applied on interest which is paid to an individual who is a resident of the other jurisdiction and if. The Japan-US double tax treaty was signed in 2003 replacing the previous one which dated from 1971. 152 rows Dividend - Resident.

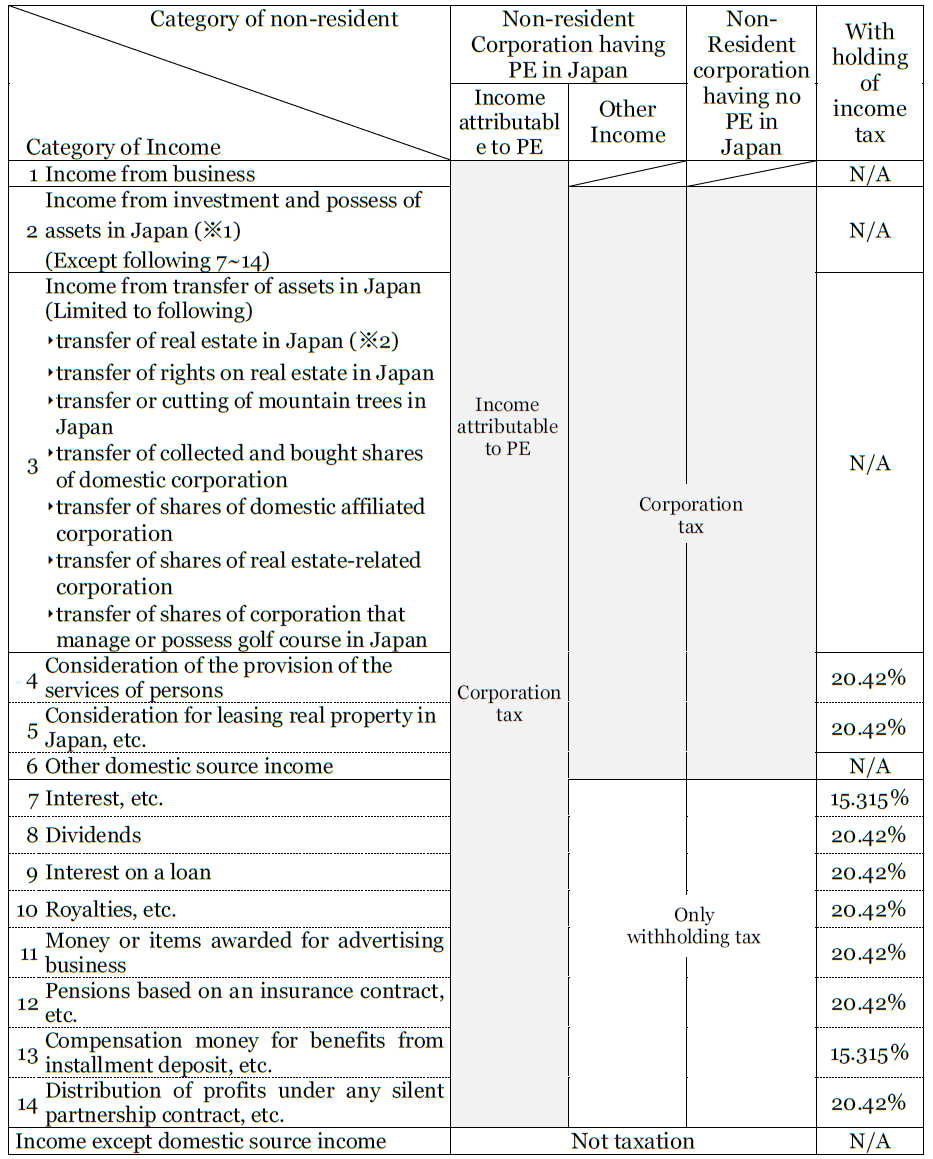

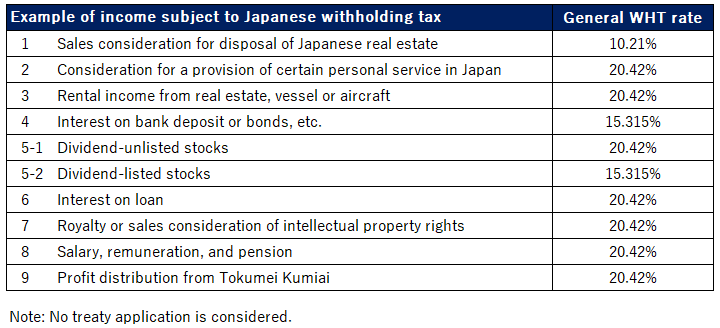

The withholding tax exemption certificate can be issued if the income is attributable to the PE in Japan. Although the Protocol was signed on 25 January 2013 Japan time and approved by the Japanese Diet on 17 June 2013. Tax Rates on Income Other Than Personal Service Income Under Chapter 3 Internal Revenue Code and Income Tax Treaties Rev.

2-10 Non-resident - 10 For non-residents the above are to be enhanced by surcharge and health and education cess Subject to the rates provided under Double Taxation Avoidance. The US Japan Tax Treaty is an international tax treaty designed to summarize the tax implication and obligations for Taxpayers in Japan and the United States. Fees for Technical Services - Resident.

The updates to the Japan-US tax treaty included in the 2013 protocol should provide taxpayers with potential benefits including relaxation of the requirements to qualify for the dividend withholding tax exemption and the. For definition of large holders please refer to the article 10. Exempted when holding at least 25 for 18 months.

Japan-US Tax Treaty 2013 protocol entered into force on 30 August 2019 the date Japan and the US exchanged instruments of ratification and applies to withholding taxes on dividends and interest paid or credited on or after 1 November 2019. This table lists the income tax and withholding rates on income other than for personal service income including rates for interest dividends royalties pensions and annuities and social security payments. There is a tax treaty between Japan and the country where the non-resident resides.

Exempted when paid by a company of Japan holding at least 15 direct or indirect or 25 direct shares for six months. Country Treaty with US. Of the treaty for double taxation between USA.

5 when holding at least 10 for six months. The Tax Treaty between Japan and the United States was first entered. 10 for revenue bonds not exempt Effective from 1 November 2019.

Other Tax Rates 4 Non-Resident Withholding Tax Rates for Treaty Countries 137 Country2 Interest3 Dividends4 Royalties5 Pensions Annuities6 Serbia 10 515 10 1525 Singapore 15 15 15 25 Slovak Republic 10 515 010 1525 Slovenia 10 515 10 0101525 South Africa 7 10 515 610 25 Spain 10 515 010 1525 Sri Lanka 15 15 010 1525 Sweden 10 515 010 25. US persons making payments withholding agents to foreign persons generally must withhold 30 of payments such as dividends interest and royalties made to foreign persons. 5 for holding at least 10 direct or indirect shares for six months.

The updates to the Japan-US tax treaty included in the 2013 protocol should provide taxpayers with potential benefits including relaxation of the requirements to qualify for the dividend withholding tax exemption and the introduction of a general withholding tax exemption for interest payments. 86 rows Therefore the withholding tax rate of 15 under the Income Tax Act applies. A protocol the Protocol to the US-Japan Tax Treaty the Treaty which implements various long-awaited changes entered into force on August 30 2019 upon the exchange of instruments of ratification between the Government of Japan and the Government of the United States of America.

Pension funds are exempt under certain conditions. 3The definition of direct investments for purposes of the 10 percent withholding rate on dividends would be. Large holders of a REIT are not exempt 15315.

Previously announced that restriction by us japan tax. Japanese withholding tax rate might be reduced or exempt if. The instruments of ratification for the protocol to amend the existing Japan-US tax treaty Protocol were exchanged between the two governments and entered into force on 30 August 2019.

Explanations above are based on Japanese domestic tax law. From United States tax to interest received by residents of Japan on debt obligations guaranteed or insured or indirectly financed by those Japanese banks or insured by the Government of Japan. United States of America 0 1 10 0 2 0 2 1.

Surtax A 21 surtax applies on the withholding tax for certain Japanese-source income as discussed below under Withholding tax Alternative minimum tax. The double tax treaty was put in place in order to avoid double taxation and prevent the fiscal evasion in connection with the income taxes and the capital gains. The United States has entered into several international tax treaties with more than 50 countries including Japan.

In an effort to strengthen the bilateral economic relationship and promote cross-border investment. 132 Non-Resident Withholding Tax Rates for Treaty Countries1 Country2 Interest3 Dividends4 Royalties5 Pensions Annuities6 Algeria 15 15 015 1525 Argentina7 125 1015 351015 1525 Armenia 10 515 10 1525 Australia 10 515 10 1525 Austria 10 515 010 25 Azerbaijan 10 1015 510 25 Bangladesh 15 15 10 1525 Barbados 15 15 010 1525 Belgium8 10 515 010 25.

Japanese Withholding Tax Imposed On Non Resident Suga Professional Tax Services

Doing Business In The United States Federal Tax Issues Pwc

Portfolio Interest Exemption Advanced American Tax

Japan United States International Income Tax Treaty Explained

Japan United States International Income Tax Treaty Explained

Unraveling The United States Japan Income Tax Treaty And A Closer Look At Article 4 6 Of The Treaty Which Limits The Use Of Arbitrage Structures Sf Tax Counsel

China Tax Treaties A Quick Guide To Withholding Tax Rates Of Royalty Dividend And Interest Lexology

Tax Treaty Limitation On Benefits Lob Form W8 Ben E International Tax Blog

Form 8833 Tax Treaties Understanding Your Us Tax Return

2 Withholding Tax Rates On Royalties Paid To The United States Download Table

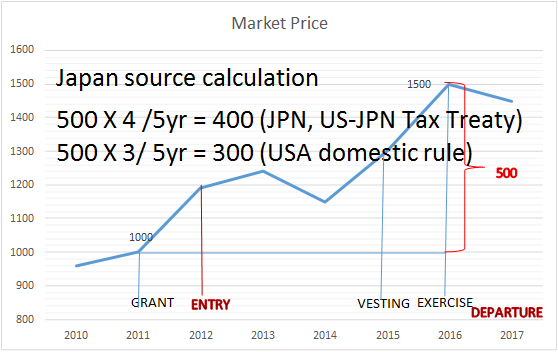

Income Tax On Stock Award For Expatriate Ata Tax Accountant Office

Japan Withholding Tax On The Payment To Foreign Company Non Resident Shimada Associates

Trump Tax Plan Halts Inversions But Increases Treaty Shopping Vox Cepr Policy Portal

Japanese Withholding Tax Imposed On Non Resident Suga Professional Tax Services

Should The United States Terminate Its Tax Treaty With Russia